This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish.

IND Solution Center | Leading Tax Software For Professionals

QUESTIONS? CALL US AT 713-679-4255

To Contact Support Call 281-400-1153

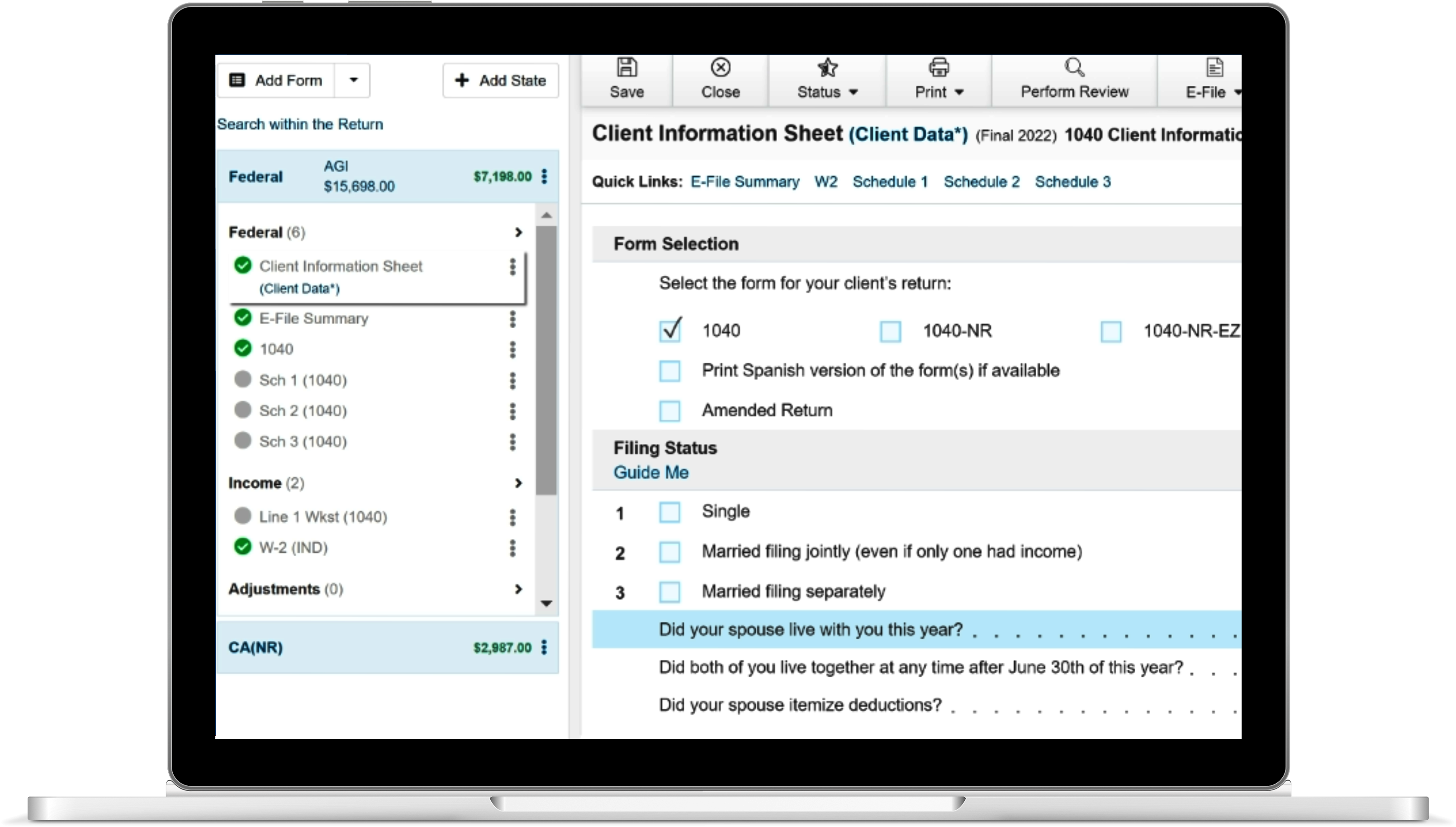

IND Solution Online

Whether you’re just starting your tax practice or have established clients, using IND Solution Online offers many benefits. You and your staff can access your software, files, and data over the web, making it easy to work remotely and giving you the flexibility to work outside of office hours, or just outside the office. Create a multi-user office without the hassle or costs of a server, and start growing your business today!

Still have questions? Call 713-679-4255 and let one of our experts help you.

100% Web-Based Software

If you are a preparer on the go or just need a tax software that is maintenance-free with nothing to download, this product is for you!

Free Digital Signature

Capture your client’s signature in the cloud on your Apple or Android mobile device.

Document Manager

Document Manager digitally stores scanned, uploaded, or client submitted documents directly in to taxpayer's return file.

Text Messaging

A simple, integrated way to send and receive unlimited text messages with your clients directly through the software.

Audit Assistance

With Audit Assistance, you can expand your service offerings and make extra revenue while providing your taxpayers with the peace of mind of low cost tax return audit assistance.

Business Forms

Our business forms offer a complete solution for tax professionals who prepare or want to prepare, even the most complex Federal and State business returns.

Taxpayer Client Portal

The client portal is a secure, user-friendly site that allows your taxpayer to stay connected without visiting your tax office.

Quick Estimator

This is a great tool that can be used to give a quick estimate to the taxpayer with the ability to start the tax return from the data entered!

Multi-Office Manager

We put realtime reporting, management of office configuration/permissions and access to the actual tax return at your fingertips.

After-The-Fact Payroll

Gives you the ability to increase your service offerings by providing Federal year-end compliance form processing. Our seamlessly integrated After-the-Fact Payroll feature allows you to:

- Record your clients’ payroll values for compliance reporting and additional purposes using Form 940 and Form 941

- E-file both Form 940 and Form 941

- E-file 1099-MISC, 1099-NEC, and W-2 forms making this a valuable tool to add revenue to your bottom line.

Data Security

Our cloud-based program was created with online data protection at the forefront of its development. Data is secure both in transit and at rest, with best-in-class TLS/SSL encryption and 256-bit AES encryption for data storage.

Spanish Features

Allows you to set up your bilingual tax office with the following Spanish features:

- Enjoy a free product demo with one of our knowledgeable Spanish sales experts to find the best plan for your business

- Our bilingual support staff can help answer questions in English or Spanish

- Print all available IRS forms in Spanish

Integrated Bank Products

We work with four trusted partners to give you the freedom and flexibility to find the best option for your clients.

- Choose a bank from the Financial Products widget on the Dashboard

- Complete the bank application within the software

- The information will flow directly into the return.